Opportunity Zones

As part of the 2017 Tax Cuts and Jobs Act, Qualified Opportunity Zones (“QOZ”) were created to spur economic development and job creation. A QOZ is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment.

The two primary preferential tax treatments are as follows:

First, an investor can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund (QOF). The deferral lasts until the earlier of the date on which the investment in the QOF is sold or exchanged, or December 31, 2026. If the QOF investment is held for at least 5 years, there is a 10% exclusion of the deferred gain. If held for at least 7 years, the 10% exclusion becomes 15%.

Second, if the investor holds the investment in the QOF for at least 10 years, the investor is eligible for an adjustment in the basis of the QOF investment to its fair market value on the date that the QOF investment is sold or exchanged. As a result of this basis adjustment, the appreciation in the QOF investment is never taxed.

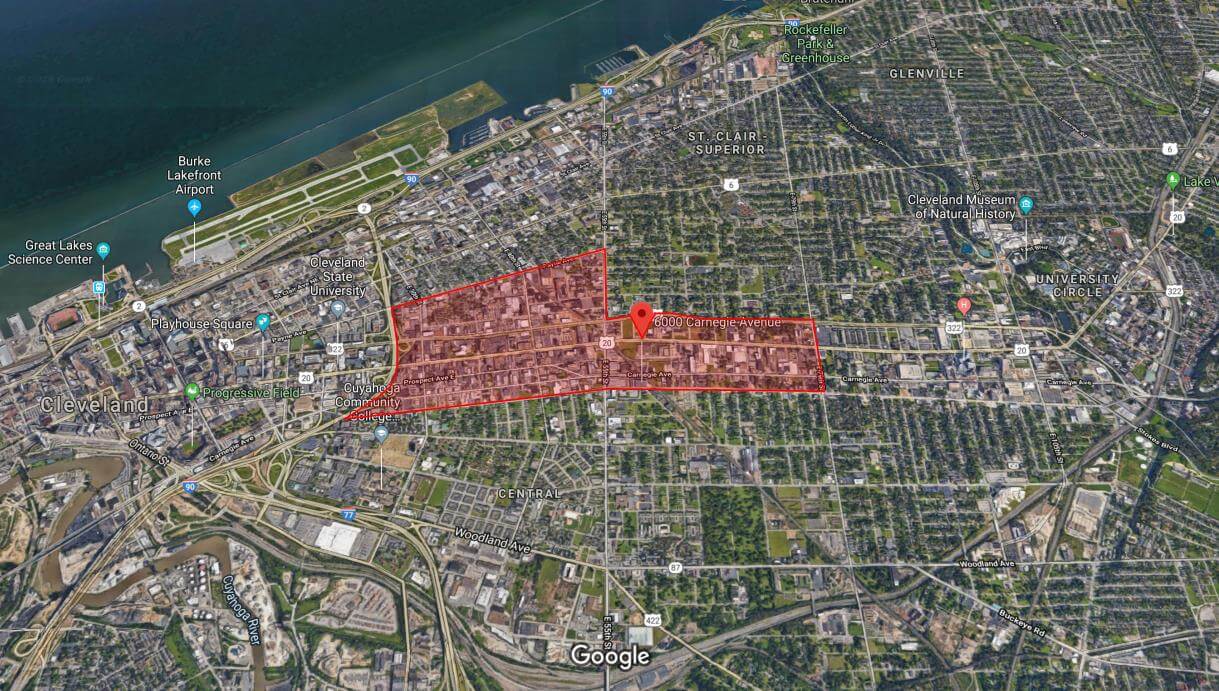

In 2018 and 2019, we were engaged by a family office to find warehouses and/or industrial properties in QOZs that were strong candidates for adaptive re-use into self-storage. We sourced a few actionable properties and presented each to the client along with market studies, rent comparison analysis, conceptual building plans, conceptual development budgets, conceptual pro formas and go-forward recommendation.